Student loan overpayment debt collection occurs when a borrower has received more money than they were entitled to in federal student aid, such as a Pell Grant or a student loan disbursement. The overpayment may have occurred due to various reasons, including changes in the student’s enrollment status or the disbursement of funds from multiple sources.

The Department of Education or the loan servicer will typically notify the borrower of the overpayment and demand repayment. If the borrower fails to repay the overpayment, the Department of Education may take collection actions, such as withholding tax refunds, garnishing wages, or referring the debt to a collection agency.

Borrowers who are unable to repay the overpayment may be eligible for a repayment plan or a compromise settlement. It is important for borrowers to stay in communication with the Department of Education or the loan servicer to avoid defaulting on their student loans and facing harsh collection actions.

Student Loan Overpayment Debt Collection

The Student Loan Company (SLC) is a government department tasked with evaluating and providing financial assistance to aspiring students seeking to study at a college or university.

The SLC is responsible for disbursing student loans and grants to eligible students, as well as facilitating the collection of loan repayments once students begin their careers.

The repayment of student loans is only required when the student earns above a particular threshold, which varies depending on the student’s country of residence.

However, grants, which are awarded to students who are determined to require additional financial support, typically after an assessment of their parents’ or guardians’ income, are not required to be repaid.

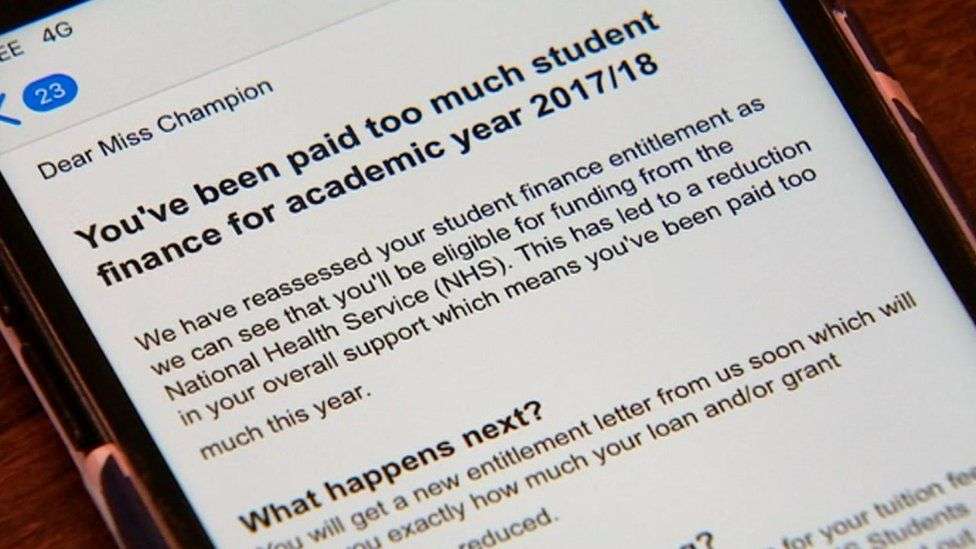

Student Loan Overpayment Letter

A student loan overpayment letter typically informs the borrower that they have made more payments than necessary toward their student loan. The letter usually includes details about the amount overpaid, the reason for the overpayment, and instructions on how to request a refund or apply the overpayment to future loan payments.

Having the student loan overpayment letter can also be helpful if you need to dispute any discrepancies on your student loan account or if you need to provide documentation for tax purposes.

It is important to keep track of your student loan payments and balances and to review your account statements regularly to ensure that your payments are being applied correctly. If you have any questions or concerns about your student loan account, it is best to contact your loan servicer as soon as possible.

Student Loan Overpayment Repayment Plan

A student loan overpayment repayment plan is an option available to borrowers who have overpaid their student loans and are not eligible for a refund. In this case, the borrower can request to apply the overpayment to their outstanding loan balance or set up a repayment plan with the loan servicer.

To request a repayment plan, the borrower should contact their loan servicer and provide them with a copy of their student loan overpayment letter. The loan servicer will review the borrower’s account and determine if they are eligible for a repayment plan.

If approved, the loan servicer will provide the borrower with details about the repayment plan, including the amount of the overpayment that will be applied to the loan balance, the new monthly payment amount, and the duration of the repayment plan.

The new monthly payment amount will be adjusted based on the remaining loan balance and the repayment plan selected by the borrower.

It is important for borrowers to review the repayment plan carefully and make sure that they can afford the new monthly payment amount. If the borrower has any questions or concerns about the repayment plan or their student loan account, they should contact their loan servicer for assistance.

Student Loan Overpayment Refund

If you’ve overpaid on your student loans, you may be entitled to a refund. To get a refund, you should contact your loan servicer or lender. They can tell you what steps you need to take to request a refund.

It’s important to note that overpaying on your student loans can have a positive impact on your overall loan balance and may help you pay off your loans more quickly. Kindly the simple ways you can apply get back your student loan overpayment refund

- You will need to contact your loan servicer or lender: You can find their contact information on your loan statement or by logging into your online account. Explain that you’ve overpaid and ask for a refund.

- Kindly provide proof of overpayment: Your loan servicer may ask you to provide documentation to prove that you’ve overpaid. This could include bank statements or payment receipts.

- You will need to request for a refund: Once your loan servicer has confirmed that you’ve overpaid, you can request a refund. You may be able to choose how you want to receive your refund, such as a direct deposit into your bank account or a check in the mail.

- Kindly be patient and wait for your refund: It may take several weeks for your refund to be processed and sent to you. Be sure to keep track of the status of your refund and follow up with your loan servicer if you haven’t received it within a reasonable amount of time.

Student Finance Overpayment Hardship

If you have overpaid on your student loans and are experiencing financial hardship as a result, there are options available to you. Here are some steps you can take:

- You will need to contact your loan servicer or lender and explain your situation and ask if there are any options available to you, such as a refund or a repayment plan that takes your financial situation into account.

- Explore repayment plan options and If you’re struggling to make your monthly payments, you may be eligible for an income-driven repayment plan. These plans base your monthly payment on your income and family size, which can make them more affordable.

- You will need to consider deferment or forbearance, If you’re experiencing a temporary financial hardship, you may be eligible for a deferment or forbearance. These options allow you to temporarily stop making payments or reduce your monthly payment for a period of time.

- You will need to seek help from a financial counselor and If you’re unsure about your options or need help navigating the student loan repayment process, consider seeking help from a financial counselor. These professionals can provide guidance and support as you work to manage your student loan debt.

Remember, it’s important to stay in communication with your loan servicer or lender if you’re experiencing financial hardship. They may be able to work with you to find a solution that fits your situation.

Overpaid Student Loan Due to a Bonus

If you overpaid your student loan due to a bonus, it means that you made a payment that was higher than the required minimum payment on your student loan because you received a bonus from your employer or some other source of income.

For example, let’s say your monthly student loan payment is $200, but you received a bonus of $500 from your employer. You decide to use that extra money to make a larger payment on your student loan, and you make a payment of $700 instead of the minimum required payment of $200.

In this case, you have overpaid your student loan by $500 because you made a payment that was larger than the required amount. This can be a good thing because it can help you pay off your loan faster and reduce the amount of interest you pay over time.

However, it’s important to make sure you’re not overpaying to the point where it causes financial hardship or leaves you without enough money to cover your other expenses. Be sure to monitor your account and adjust your payments as needed to ensure you’re making the most of any extra income you receive

Student Finance Says I Owe Them Money

If you received a notice from student finance saying you owe them money, there are a few possible reasons why this could have happened:

- That type of message simply means you didn’t make your monthly payments on time and If you missed one or more payments, your loan balance may have increased, and you could owe more money than you originally borrowed.

- There was an error in your loan balance, so it’s possible that there was an error in your loan balance, which could have resulted in you owing more money than you should have.

- Maybe you were overpaid and if you received more financial aid or student loan funds than you were eligible for, you may have been overpaid, and now owe the excess funds back.

- Maybe your loan terms changed If you have a variable interest rate or your loan terms changed for some other reason, it’s possible that your monthly payments or total loan balance could have increased.

Student Finance Login

To log in to your student finance account, you will need to follow these steps:

Go to the student finance website for your country and if you didn’t see your county of choice here, we are sorry for that.

- If you’re in England, go to www.gov.uk/student-finance.

- If you’re in Scotland, go to www.saas.gov.uk.

- If you’re in Wales, go to www.studentfinancewales.co.uk.

- If you’re in Northern Ireland, go to www.studentfinanceni.co.uk.

Click on the “Log in” button in the top right-hand corner of the page.

Enter your username and password.

Once you have entered your login credentials, click on the “Log in” button.

If you’re logging in for the first time, you will need to create an account and set up a username and password.

You should now be logged in to your student finance account, where you can view your loan balance, make payments, and manage your account settings.

Student Loan Refund Process

The process for obtaining a student loan refund depends on several factors, including the type of loan you have, the reason for the refund, and the policies of your loan servicer or lender.

Here are some general steps you can take to request a student loan refund:

- Contact your loan servicer or lender: The first step in requesting a student loan refund is to contact your loan servicer or lender. Explain why you believe you are eligible for a refund and ask what steps you need to take to initiate the process.

- Submit documentation: Depending on the reason for your refund, you may need to provide documentation to support your claim. For example, if you dropped out of school or your enrollment status changed, you may need to provide transcripts or other proof of your status.

- Wait for processing: Once you have submitted your request and any required documentation, your loan servicer or lender will review your claim and determine if you are eligible for a refund. This process can take several weeks or even months, depending on the complexity of your case.

- Receive your refund: If your claim is approved, your loan servicer or lender will issue a refund to you or to the institution that originated the loan on your behalf. The refund may be in the form of a check, direct deposit, or credit to your account.

It’s important to note that not all student loan refunds are guaranteed, and there may be fees or other costs associated with the refund process. Be sure to carefully review your loan agreement and speak with your loan servicer or lender to understand the terms and conditions of your loan.