BANKING IN INDIA

India Banking system has become the talk of the day and the progress of India financial status has been the follower of other countries. Talking about the Banks institute without mentioning the India Banking system means that the banking system circuit has not been completed because of the way India banking system is grown so global in the world.

HISTORY OF BANKING IN INDIA

The History of banking in India states that the post-independence, the Government of India initiated various measures to play an active role in the economic development of the nation which resulted in the establishment of the Reserve Bank of India in April 1935 and later nationalized the same during 1949 under the terms of the Reserve Bank of India Act of 1948 and another measure is the nationalization of banks in India.

Post-independence, the Indian government adopted a planned economic development for the betterment of the country. The government of India under the leadership of the then Prime Minister Indira Gandhi issued an ordinance to nationalize 14 largest commercial banks in India with effect from July 19, 1969, under the regulatory authority of the Reserve Bank of India. These 14 banks contained up to 85 percent of bank deposits in the country and most of them were privately owned. During 1980, 6 more commercial banks followed the suit and came under nationalized cover. Till the 1990s, their growth grew at a snail’s pace of around 4% annually.

BANKING DEVELOPMENT AND NATIONALIZATION OF BANKS IN INDIA

Nationalization refers to the transfer of public sector assets to be operated or owned by the state or central government. In India, the banks which were previously functioning under the private sector were transferred to the public sector by the act of nationalization and thus the nationalized banks came into existence.

The nationalization of commercial banks was made so acceptable and comfortable in a way that many citizens is benefiting from. After nationalization, there was a shift of emphasis from industry to agriculture. The country witnessed rapid expansion in bank branches, even in rural areas. However, bank nationalization created its problems like excessive bureaucratization, red-tapism and disruptive tactics of trade unions of bank employees. It was in this backdrop that wide-ranging banking sector reforms were introduced as an integral part of the economic reforms programme started in the early 1990s and which is still underway.

Reasons for the Nationalization of Banks

• To Promote Social Welfare

• For Developing Banking Habits

• For Expansion of Banking Sector

• For Controlling Private Monopolies

• To Reduce Regional Imbalance

• For Prioritizing Sector Lending

THE FINANCIAL PUBLIC SECTOR BANKS IN INDIA

Banks such as State Bank of India, Bank of Baroda, Syndicate Bank and Canara Bank are known as Public sector banks. Public sector banks are controlled and managed by the Government of India. Public sector banks have been serving the nation for over centuries and are well known for their affordable and quality services.

The banking sector in India is mostly dominated by the Public sector banks. The Public sector banks in India alone account for about 75 percent of the total advances in the Indian banking industry. Public sector banks have shown remarkable growth over the last five four decades.

The Indian banking sector has witnessed wide-ranging changes under the influence of the financial sector reforms initiated during the early 1990s. The approach to such reforms in India has been one of gradual and non-disruptive progress through a consultative process. The emphasis has been on deregulation and opening up the banking sector to market forces. The Reserve Bank has been consistently working towards the establishment of an enabling regulatory framework with prompt and effective supervision as well as the development of technological and institutional infrastructure.

Persistent efforts have been made towards the adoption of international benchmarks as appropriate to Indian conditions. While certain changes in the legal infrastructure are yet to be affected, the developments so far have brought the Indian financial system closer to global standards.

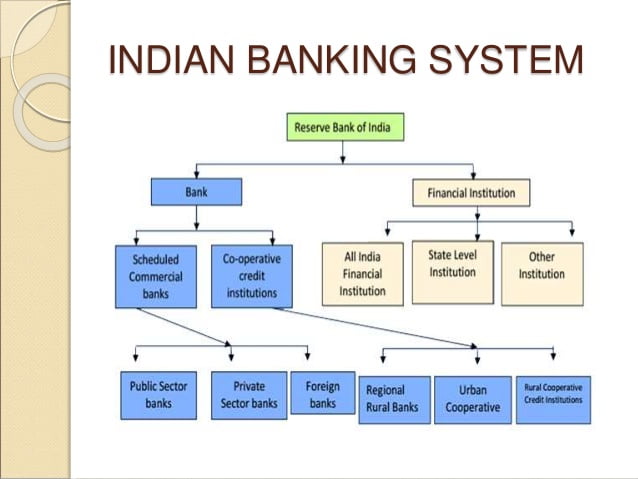

Private banks are today increasingly displacing nationalized banks from their positions of pre-eminence. Though the nationalized State Bank of India (SBI) remains the largest bank in the country by far, private banks like ICICI Bank, Axis Bank, and HDFC Bank have emerged as important players in the retail banking sector. Though spawned by government-backed financial institutions in each case, they are profit-driven professional enterprises. Financial Sector in India consists of three main segments which are :

- Financial institutions -banks, mutual funds, insurance companies

- Financial markets -money market, debt market, capital market, forex market

- Financial products -loans, deposits, bonds, equities

BANKING SYSTEM SECTOR INTRODUCTION INDIA is the lifeline of any modern economy. It is one of the important financial pillars of the financial sector, which plays a vital role in the functioning of an economy. … They play an important role in the mobilization of deposits and disbursement of credit to various sectors of the economy.